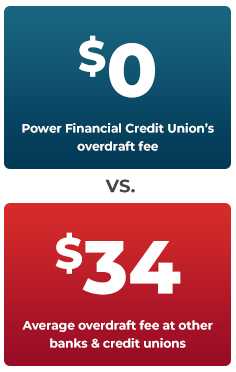

Last year alone, banks and credit unions charged over $30 billion in overdraft fees. The average overdraft fee is $34. That is a new record high, rising for the 20th time in the past 22 years.

The bottom line is that overdraft fees hurt consumers, especially those individuals and families are most vulnerable financially.

When you bank with us you are part of our family and family doesn’t take advantage when you need them most. That is why we decided to do what we always do — put the financial needs of our members above all else.

We are proud to be the first credit union in Delaware and one of the few financial institutions nationally to fully eliminate overdraft and non-sufficient funds fees.

There are two types of standard fees when you overdraft depending on whether or not the transaction is paid by your financial institution.